- Introduction: The Investment Landscape in 2025

- Stock Market Opportunities

- Growth stocks

- Dividend stocks

- Sector outlook (tech, healthcare, energy, etc.)

- Graph: Stock market growth trends

- Exchange-Traded Funds (ETFs) and Index Funds

- Why they’re popular now

- Long-term vs. short-term investors

- Real Estate Investment

- Housing market 2025 overview

- REITs vs. direct ownership

- Graph: Housing price index trend

- Bonds and Fixed Income

- Treasuries, corporate bonds, municipal bonds

- Role in a balanced portfolio

- Graph: Bond yields comparison

- Commodities and Precious Metals

- Gold, silver, oil, and new commodities (like lithium)

- Safe-haven vs. speculative plays

- Cryptocurrency and Digital Assets

- Bitcoin, Ethereum, stablecoins

- Risks vs. opportunities in 2025

- Graph: Bitcoin historical volatility

- Alternative Investments

- Private equity, venture capital, hedge funds

- Art, collectibles, and fractional ownership platforms

- Sustainable and ESG Investing

- Clean energy

- Green bonds

- Impact investing opportunities

- Retirement Accounts (IRA, 401k, Roth IRA)

- Why tax-advantaged investing matters in 2025

- Short-Term vs. Long-Term Strategies

- Building a diversified portfolio

- The psychology of staying invested

- Regional Hotspots in America

- Where real estate and businesses are booming (Sun Belt, tech hubs)

- Final Thoughts: Building Wealth in a Shifting Economy

📊 Throughout, I’ll include graphs (e.g., stock index growth, real estate trends, bond yield curves) to make it visually engaging.

Stock Market Opportunities in America (2025)

The U.S. stock market remains the heartbeat of global investing. Despite occasional volatility, it continues to be one of the most reliable long-term wealth builders. In 2025, investors face a mix of challenges — inflationary pressures, global geopolitical shifts, and interest rate adjustments — but also a sea of opportunities if they know where to look.

1. Growth Stocks: Fuel for the Future

Growth stocks are companies expected to expand earnings at a faster rate than the market average.

- Technology & AI Leaders: Artificial intelligence, cloud computing, and semiconductors continue to drive explosive growth. Companies leading in automation, chip design, and AI services are poised for multi-year expansions.

- Healthcare Innovators: Biotech firms, gene-editing pioneers, and telemedicine providers remain in the spotlight. Aging populations and medical breakthroughs fuel steady demand.

- Green Energy Companies: Solar, wind, and electric vehicle infrastructure play into America’s shift toward sustainable energy independence.

Why Invest? Growth stocks thrive when innovation reshapes industries. While more volatile, they reward investors willing to hold through cycles.

2. Dividend Stocks: Stability with Passive Income

Not everyone wants high-octane risk. Dividend-paying companies provide both stability and regular cash flow.

- Blue-Chip Companies: Firms like those in consumer staples, utilities, and financials often deliver consistent dividend payouts.

- Dividend Aristocrats: These are companies that have raised dividends for 25+ consecutive years.

- Utility and Telecom Sectors: They benefit from predictable demand and steady cash flows.

Why Invest? Dividend stocks are attractive in uncertain times, providing a cushion through regular payouts while still offering potential appreciation.

3. Sector Outlook for 2025

Different sectors in the U.S. economy are moving at different speeds.

- Technology: Still dominant, especially AI, cloud, and cybersecurity.

- Healthcare: Growth fueled by innovation and demographic trends.

- Energy: Traditional oil & gas remain strong due to global demand, but renewables gain traction.

- Financials: Banks benefit from stable interest rates and rising digital banking adoption.

- Consumer Discretionary: E-commerce, travel, and luxury goods benefit from resilient U.S. spending.

4. Small-Cap vs. Large-Cap

- Large-Cap Companies: Stability, strong balance sheets, and global reach make them safer bets in uncertain economies.

- Small-Cap Companies: Higher risk but can deliver outsized returns, especially in innovation-driven sectors.

A balanced mix of both can position investors for steady growth with upside potential.

5. Graph: Stock Market Growth Trends

Here’s a simple visualization of U.S. stock market index performance over time, highlighting its resilience despite downturns

6. Key Takeaways for Stock Market Investors in 2025

- Diversify sectors: Don’t chase only tech — include healthcare, energy, and financials.

- Balance growth with dividends: Combine fast-growing innovators with income-generating stocks.

- Stay long-term focused: Markets swing, but patience builds wealth.

- Use downturns as entry points: Historically, corrections have been the best buying opportunities.

ETFs and Index Funds — The Modern Investor’s Choice

Investing in America today is not just about picking individual stocks. For many, the smartest path lies in ETFs (Exchange-Traded Funds) and Index Funds. They offer diversification, lower risk compared to single-stock bets, and are often the backbone of both beginner and advanced investment portfolios.

1. Why ETFs and Index Funds Dominate Modern Investing

- Diversification in One Move: Instead of buying 50 different stocks, an ETF or index fund lets you own a basket instantly.

- Lower Costs: Many ETFs have expense ratios below 0.10%, making them cheaper than traditional mutual funds.

- Liquidity & Flexibility: ETFs trade like stocks, so you can buy or sell them during market hours.

- Steady Wealth Building: Index funds mirror market benchmarks like the S&P 500, giving exposure to America’s top companies.

These features make them attractive for investors who want simplicity without giving up performance.

2. Popular Types of ETFs in 2025

Different ETFs serve different investment goals.

| ETF Type | What It Tracks | Best For |

|---|---|---|

| Broad Market ETFs | S&P 500, Total Market | Beginners, passive investors |

| Sector ETFs | Technology, Healthcare, Energy | Investors betting on specific industries |

| Dividend ETFs | High-yield dividend-paying companies | Income-focused investors |

| Bond ETFs | U.S. Treasuries, corporate bonds | Conservative investors |

| Thematic ETFs | AI, clean energy, blockchain | Trend-focused, risk-tolerant investors |

3. Why Index Funds Still Shine

Index funds might not trade like ETFs, but they remain a gold standard for retirement accounts like 401(k)s and IRAs.

- Consistency: They aim to match the performance of a market index.

- Long-Term Growth: Over decades, index funds like the S&P 500 have delivered reliable returns.

- Set-and-Forget: Ideal for people who don’t want to check their portfolio daily.

4. Performance: ETFs vs. Index Funds

Both can be strong choices, but here’s how they stack up:

| Feature | ETFs | Index Funds |

|---|---|---|

| Trading | Traded all day like stocks | Priced once daily (end of trading session) |

| Flexibility | High — can buy/sell anytime | Lower — designed for long-term holding |

| Costs | Often very low | Slightly higher (but still low) |

| Best Use Case | Active/passive mix, flexible investing | Retirement savings, long-term compounding |

5. Graph: Why Investors Choose ETFs & Index Funds

6. The Rise of Thematic ETFs

In 2025, thematic ETFs are stealing attention. These funds don’t just track markets — they track megatrends.

Examples include:

- AI & Robotics ETFs — benefiting from automation across industries.

- Clean Energy ETFs — reflecting America’s transition toward renewables.

- Cybersecurity ETFs — growing as data protection becomes critical.

These funds carry more risk but let investors ride future-focused waves.

7. Key Takeaways

- ETFs = flexibility + cost efficiency.

- Index Funds = long-term compounding power.

- Both beat stock picking for most investors due to built-in diversification.

- In 2025, ETFs focused on AI, green energy, and healthcare are among the hottest choices.

Real Estate Investment in America (2025)

Real estate has always been a cornerstone of wealth building in America. From the suburban housing boom of the post-WWII era to today’s fast-growing urban hubs and Sun Belt states, property remains a symbol of stability and prosperity. In 2025, despite inflation and rising interest rates in recent years, real estate continues to stand strong as a long-term investment option.

Whether you’re investing in a single-family rental, buying shares of a REIT, or diversifying through real estate crowdfunding, there are plenty of opportunities — even if you don’t have a fortune to start with.

1. Why Real Estate Still Matters

- Tangible Asset: Unlike stocks or crypto, real estate is physical. People always need places to live and work.

- Hedge Against Inflation: Property values and rents tend to rise when inflation is high, protecting investor purchasing power.

- Cash Flow: Rental properties provide monthly income, often more stable than dividends.

- Leverage: You can borrow (mortgage) to invest, amplifying returns.

2. Real Estate Market Trends in 2025

The U.S. real estate market is reshaping itself in interesting ways:

- Urban Revival: Cities like New York and San Francisco are recovering as hybrid work stabilizes.

- Sun Belt Growth: States like Texas, Florida, and Arizona attract buyers for lower taxes and warm climates.

- Suburban Strength: Families continue moving to suburbs for affordability and space.

- Multi-Family Housing: Rising rents fuel demand for apartment investments.

Graph: U.S. Housing Price Index (2015–2025)

3. Different Ways to Invest in Real Estate

| Method | How It Works | Best For | Pros | Cons |

|---|---|---|---|---|

| Direct Ownership | Buy residential/commercial property | Long-term investors | Tangible asset, rental income | High upfront cost, management headaches |

| REITs (Real Estate Investment Trusts) | Buy shares of companies owning properties | Beginners, passive investors | Easy to buy/sell, dividends | Sensitive to interest rates |

| Real Estate Crowdfunding | Pool money online with other investors | Small investors | Low entry cost, access to big projects | Less liquid, platform fees |

| House Flipping | Buy, renovate, resell | Risk-takers | Quick profit potential | High risk, market timing crucial |

| Vacation Rentals (Airbnb, VRBO) | Rent properties short-term | Investors in tourist areas | High rental yields | Seasonal demand, regulation risk |

4. The Role of REITs in 2025

REITs are one of the simplest ways to gain real estate exposure without becoming a landlord. They’re publicly traded and allow investors to earn dividends from property income.

Top REIT Categories:

- Residential REITs → Apartments, housing communities

- Retail REITs → Shopping malls, outlets

- Industrial REITs → Warehouses, logistics hubs (booming due to e-commerce)

- Healthcare REITs → Hospitals, senior living facilities

- Office REITs → Still struggling in some cities due to remote work

5. Risks to Watch

Even though real estate is appealing, it’s not risk-free:

- Rising Interest Rates → Mortgages become expensive, slowing housing demand.

- Regulatory Risks → Rent controls or zoning laws can impact profitability.

- Economic Downturns → Property values can fall in recessions.

- Liquidity Issues → Unlike stocks, selling property can take months.

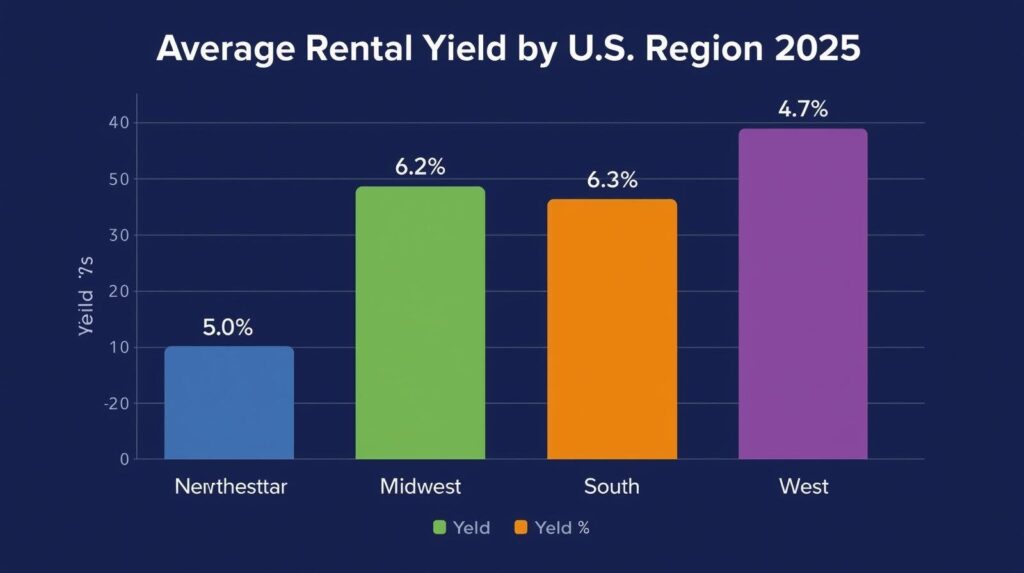

6. Graph: Average Rental Yield by Region (2025)

7. Key Takeaways

- Real estate in 2025 is about location and adaptability.

- Direct ownership offers control but requires capital.

- REITs and crowdfunding make it easier for everyday investors.

- Sun Belt states and multi-family housing are hot opportunities.

- Diversifying into real estate can stabilize your portfolio in volatile markets.

Bonds and Fixed Income — The Safe Side of Investing in 2025

When investors think about growing wealth, stocks usually take center stage. But when it comes to safety, stability, and income, bonds and fixed-income investments are the unsung heroes. In 2025, with economic uncertainties, inflation adjustments, and shifting interest rates, bonds remain essential for anyone seeking balance in their portfolio.

1. Why Bonds Still Matter

- Steady Income: Bonds pay interest (called coupon payments), which provides predictable cash flow.

- Capital Preservation: Less volatile than stocks, making them ideal for risk-averse investors.

- Diversification: When stocks tumble, bonds often hold steady or rise.

- Inflation Protection: Some bonds, like TIPS, adjust payouts with inflation.

2. Different Types of Bonds in 2025

| Type of Bond | What It Is | Risk Level | Who It’s For |

|---|---|---|---|

| U.S. Treasuries | Debt issued by U.S. government | Very Low | Conservative investors, retirees |

| Corporate Bonds | Debt issued by companies | Medium to High (depends on company) | Investors seeking higher yields |

| Municipal Bonds | Issued by state/local governments | Low to Medium | Tax-conscious investors |

| High-Yield (Junk) Bonds | Corporate debt with lower credit rating | High | Risk-takers looking for big yields |

| TIPS (Treasury Inflation-Protected Securities) | Treasuries adjusted for inflation | Low | Those worried about rising prices |

3. The Role of Bonds in a Portfolio

A healthy investment portfolio isn’t all stocks or all real estate — it’s about balance. Traditionally, the 60/40 portfolio (60% stocks, 40% bonds) was the standard. But in 2025, many advisors suggest more flexible ratios depending on age and risk tolerance.

- Young Investors (20s–30s) → 80% stocks, 20% bonds

- Middle-Age Investors (40s–50s) → 60% stocks, 40% bonds

- Retirees (60+) → 40% stocks, 60% bonds

Graph: Stocks vs. Bonds Risk/Return Comparison

4. Bond Yields in 2025

Bond yields have been adjusting as interest rates shift. Investors must understand that when interest rates rise, bond prices fall, and vice versa.

| Bond Type | Average Yield (2025) |

|---|---|

| U.S. Treasuries (10Y) | ~4.2% |

| Corporate Bonds (AAA) | ~5.5% |

| Corporate Bonds (BBB) | ~6.7% |

| High-Yield Bonds | ~8.5% |

| Municipal Bonds | ~3.8% |

5. Fixed-Income Alternatives

Besides bonds, there are other fixed-income products worth considering:

- Certificates of Deposit (CDs) → Bank products with fixed interest. Safe but less liquid.

- Money Market Accounts → Safe, low-return accounts good for emergency funds.

- Fixed Annuities → Insurance products guaranteeing income in retirement.

6. Risks to Watch in Bond Investing

Even “safe” investments carry risks.

- Interest Rate Risk → If rates go up, bond values drop.

- Credit Risk → Companies or municipalities could default.

- Inflation Risk → Fixed payments may lose value if inflation spikes.

- Liquidity Risk → Some bonds can be hard to sell before maturity.

Graph: Bond Yield Curve (2025 Example)

7. Key Takeaways

- Bonds remain crucial for stability and predictable income.

- Treasuries and TIPS are safe havens, while corporate and junk bonds offer higher returns but more risk.

- Fixed income helps balance out stock market volatility.

- The yield curve is a powerful tool to understand bond markets.

- In 2025, blending stocks, bonds, and alternative assets creates the most resilient portfolios