US tariff policies implemented since 2025 have created significant disruptions across global commodity markets, with effects varying dramatically by sector and region. The comprehensive tariff regime has reshaped international trade flows and triggered substantial price volatility across agricultural, industrial, and energy commodities.

Widespread Price Impacts Across Commodity Sectors

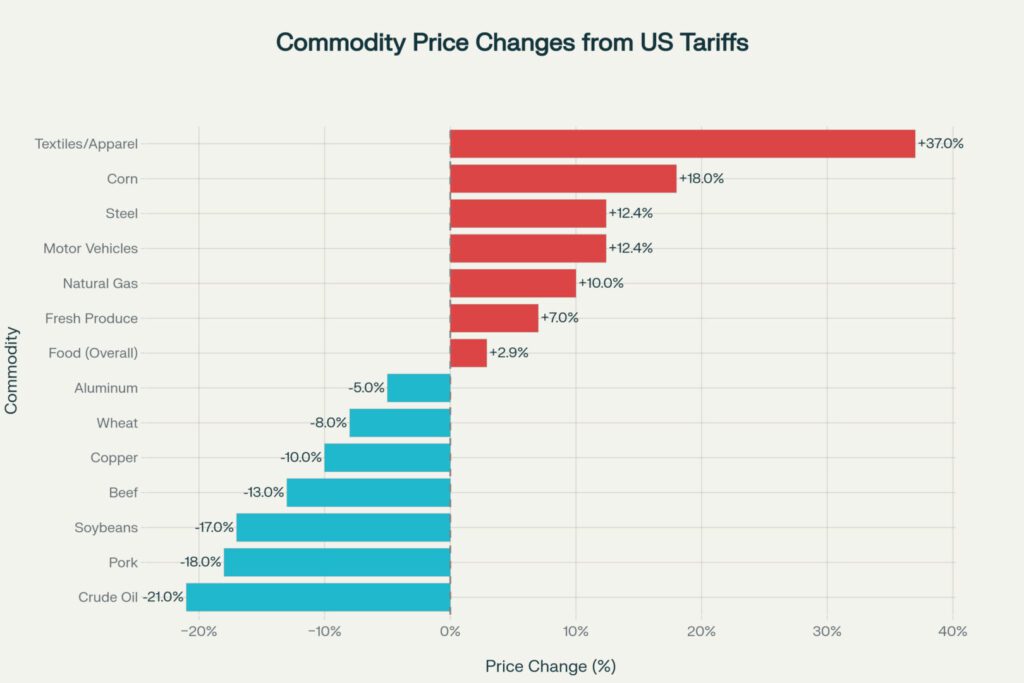

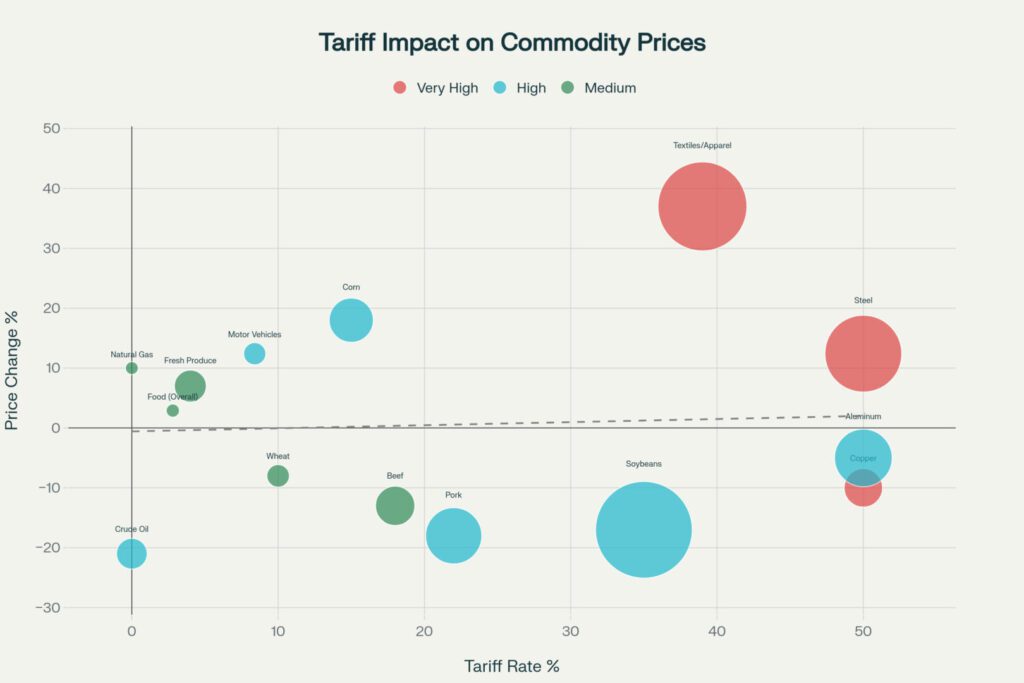

The implementation of US tariffs has produced mixed results across commodity markets, with some experiencing sharp price increases while others have seen significant declines. Textiles and apparel have faced the most severe impact, with prices surging 37% due to 39% tariffs. This dramatic increase reflects the heavy reliance of US textile imports on countries now subject to high tariffs.

Agricultural commodities have shown particularly volatile responses to the tariff regime. Corn prices surged 18% in 2025, driven by ongoing tariff impacts and shifting global demand patterns. Conversely, soybean prices are projected to decline 17% in 2025 as global production increases and trade relationships remain strained. US soybean exports to China dropped over 30% due to persistent trade tensions, forcing American farmers to seek alternative markets while competitors like Brazil expanded their market share.

Industrial metals have experienced severe disruption under the 50% tariff regime. Steel and aluminum, both subject to 50% tariffs, have seen mixed price responses – steel prices rose 12.4% while aluminum declined 5%. Copper prices initially rallied substantially before correcting 11% peak-to-trough following tariff announcements. The uncertainty surrounding potential copper tariffs has contributed to significant market volatility.

Energy Sector Shows Indirect Effects

Energy commodities, while largely exempt from direct tariffs, have experienced significant price pressures due to broader economic impacts. Crude oil prices have fallen 21% year-over-year, reaching $64 per barrel in 2025 as trade war concerns dampen global growth expectations. The decline reflects reduced industrial activity and transportation demand as global trade volumes contract.

Natural gas prices have shown more resilience, gaining 10% as domestic demand patterns shift. However, energy markets remain vulnerable to the broader economic slowdown triggered by trade tensions, with the International Energy Agency estimating a 2.4 million barrel-per-day reduction in global oil demand since January 2025.

| Commodity | Price_Change_2024_2025_Percent | Tariff_Rate_Percent | Main_Affected_Countries | Export_Volume_Change_Percent | Market_Impact_Level | Price_Volatility_Index | Trade_Disruption_Score |

|---|---|---|---|---|---|---|---|

| Soybeans | -17.0 | 35.0 | US, Brazil, Argentina | -28 | High | 22.950000000000003 | 37.800000000000004 |

| Corn | 18.0 | 15.0 | US, Brazil, Argentina | -15 | High | 20.7 | 17.25 |

| Wheat | -8.0 | 10.0 | US, Canada, Russia | -8 | Medium | 8.8 | 8.8 |

| Steel | 12.4 | 50.0 | US, Canada, Brazil | -20 | Very High | 18.6 | 30.0 |

| Aluminum | -5.0 | 50.0 | US, Canada, China | -15 | High | 7.5 | 22.5 |

| Copper | -10.0 | 50.0 | US, Chile, Peru | -10 | Very High | 15.0 | 15.0 |

| Crude Oil | -21.0 | 0.0 | Global | -12 | High | 21.0 | 12.0 |

| Natural Gas | 10.0 | 0.0 | US, Russia | 5 | Medium | 10.0 | 5.0 |

| Beef | -13.0 | 18.0 | US, Australia, Brazil | -13 | Medium | 15.34 | 15.34 |

| Pork | -18.0 | 22.0 | US, EU, Canada | -18 | High | 21.96 | 21.96 |

| Food (Overall) | 2.9 | 2.8 | Global | -5 | Medium | 2.9812 | 5.140000000000001 |

| Textiles/Apparel | 37.0 | 39.0 | China, Vietnam, Bangladesh | -25 | Very High | 51.43000000000001 | 34.75 |

| Motor Vehicles | 12.4 | 8.4 | Global | -8 | High | 13.441600000000001 | 8.672 |

| Fresh Produce | 7.0 | 4.0 | Mexico, Central America | -12 | Medium | 7.28 | 12.48 |

Who got the worst hit in this? Us tariff increase.

The tariff regime has created clear regional winners and losers in global commodity markets. Brazil and Argentina have emerged as significant beneficiaries, with Brazil gaining an estimated $15 billion in additional export revenue as Chinese demand shifts away from US suppliers. Brazilian soybean exports have particularly benefited from China’s diversification away from US sources.

China faces the most severe negative impacts, with export revenue declining by an estimated $45 billion and GDP contracting by 0.8%. The 125% effective tariff rate on Chinese goods has fundamentally altered trade flows, forcing Chinese exporters to seek alternative markets while flooding other regions with redirected capacity.

European Union and Canadian exporters are experiencing moderate negative impacts, with export revenues declining by $15 billion and $8 billion respectively. Canada faces particular challenges as the top US supplier of aluminum and steel products, with over half of US aluminum imports originating from its northern neighbor.

Supply Chain Disruptions Amplify Price Volatility

The tariff regime has triggered widespread supply chain reorganization, amplifying commodity price volatility beyond the direct tariff effects. Companies have implemented “China+1” strategies, shifting production to countries like Vietnam, India, and Mexico. This reshoring trend has created temporary supply imbalances and logistics bottlenecks that contribute to price instability.

Front-loading behavior has created artificial demand spikes followed by sharp corrections. The IMF noted that businesses rushed to import goods before tariff implementation, creating temporary price surges that are now reversing. This pattern has made it difficult to assess the true underlying demand for many commodities.

Manufacturing industries reliant on imported raw materials face particular challenges. Motor vehicle prices have risen 12.4%, equivalent to an additional $4,000-$6,000 per average new car. Construction and manufacturing sectors using steel and aluminum report higher costs and squeezed margins as they struggle to pass increased input costs to consumers.

How US Tariffs Affected Commodity Prices- Inflation and Consumer Impact

Consumer prices have risen significantly across tariff-affected categories. The overall food price index has increased 2.9%, with fresh produce up 7.0% in the short run. Wholesale food prices surged 1.4% in July alone, led by a 38.9% increase in vegetable prices. These increases exceed the Federal Reserve’s 2% inflation target and disproportionately affect lower-income households.

The Budget Lab at Yale estimates that US households face an average additional cost of $3,800 annually from all 2025 tariffs. This burden falls most heavily on essential goods, with clothing prices rising 17% and food prices increasing 2.8% across all tariff actions implemented in 2025.

Global Economic Growth Concerns

International financial institutions have revised global growth forecasts downward due to tariff impacts. The IMF raised its 2025 global growth forecast modestly to 3.0% but warned that this reflects temporary front-loading effects rather than underlying strength. Without these artificial demand boosts, growth could be 0.2 percentage points lower.

Emerging markets face particular vulnerability to the current trade environment. The IMF notes that unlike the COVID-19 pandemic, which allowed coordinated global policy responses, the current trade war creates asymmetric shocks that make policy coordination difficult. This situation is described as potentially more challenging for emerging market central banks than the pandemic itself.

Long-Term Market Restructuring

The current tariff regime appears to be catalyzing permanent changes in global commodity trade flows. The World Bank projects that commodity prices will continue declining through 2026, with energy prices falling an additional 6% and overall commodity prices dropping 5%. This reflects both reduced global demand and the emergence of alternative supply chains that bypass traditional US-China trade routes.

Commodity market volatility has reached levels not seen in over 50 years, according to World Bank analysis. The combination of high volatility and declining prices creates particular challenges for commodity-dependent developing economies, which may need to implement significant fiscal and structural reforms to adapt to the new trading environment.

| Region | Tariff_Exposure_Percent | Export_Revenue_Impact_Billion_USD | GDP_Impact_Percent | Commodity_Price_Impact_Percent |

|---|---|---|---|---|

| United States | 0 | 0 | 0.5 | 2.3 |

| China | 125 | -45 | -0.8 | -5.2 |

| European Union | 20 | -15 | -0.2 | 1.2 |

| Canada | 50 | -8 | -0.3 | -2.1 |

| Mexico | 25 | -5 | -0.4 | -1.8 |

| Brazil | 12 | 15 | 0.3 | 4.5 |

| Argentina | 7 | 8 | 0.2 | 3.2 |

| Australia | 8 | 3 | 0.1 | 2.1 |

| India | 50 | -4 | -0.3 | -2.5 |

| Global Average | 25 | -5 | -0.1 | 0.0 |

The comprehensive impact of US tariffs on global commodity prices demonstrates the interconnected nature of modern commodity markets and the far-reaching consequences of major trade policy shifts. While some regions and sectors have benefited from trade diversion effects, the overall impact has been one of increased volatility, higher consumer prices, and reduced global economic efficiency.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/el/register?ref=DB40ITMB