Maximize your everyday spending by understanding how cashback credit cards calculate rewards—a simple formula that turns routine purchases into real money back. This guide, tailored for cardholders and prospective applicants in the United States, United Kingdom, and Canada, breaks down reward mechanics, offers region-specific insights, and links to authoritative sources so you can choose and use your card with confidence.

Cashback credit cards return a percentage of your purchases directly to you as cash—no points, miles, or confusing conversions. Because cashback is straightforward and flexible, it’s perfect for both beginners and seasoned users. Learning precisely how cashback credit cards calculate rewards helps you align card choice with spending habits, unlocking maximum benefits.

What Is Cashback and How Does It Work?

Cashback is a rebate on eligible spending, credited back to your account as a statement credit, direct deposit, or gift card. It’s processed when purchases post to your account, not instantly at the point of sale.

- Statement credit reduces your balance

- Direct deposit sends cash to your bank (e.g., via ACH in the US)

- Gift cards or merchandise credits (some issuers)

Authoritative Resources: to How Cashback Credit Cards calculate Rewards

How Cashback Credit Cards calculate Rewards: Core Cashback Calculation Methods

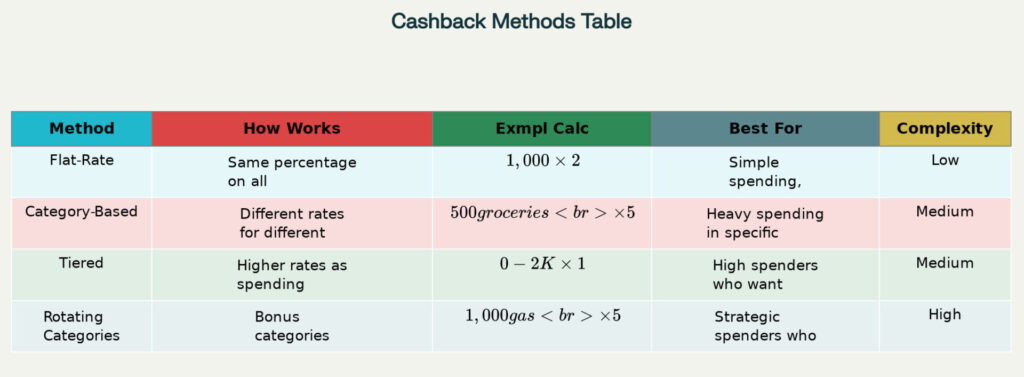

Below are the four primary ways issuers calculate cashback. Choose a method that aligns with your spending profile.

| Method | How It Works | Example Calculation | Best For | Complexity |

|---|---|---|---|---|

| Flat-Rate | Uniform rate on all purchases (e.g., 1.5%–2%). | $1,000 × 2% = $20 | Varied spending, simplicity seekers | Low |

| Category-Based | Higher rates (3%–6%) in select categories; lower base rate elsewhere. | $500 groceries × 5% + $500 other × 1% = $30 | Heavy spenders in key categories | Medium |

| Tiered | Rates increase as you cross spending thresholds (e.g., 1% up to $2K, 2.5% above). | $3K at 1% + $2K at 2.5% = $60 on $5K | High-volume spenders | Medium |

| Rotating Categories | 5% back in quarterly categories (gas, groceries, online); requires activation; caps apply. | Q1 gas $1,000 × 5% = $50 | Strategic planners, seasonal shoppers | High |

The Simple Cashback Formula to know How Cashback Credit Cards calculate Rewards

At its heart, the math is easy: Cashback Earned=Purchase Amount×Cashback Rate (decimal)Cashback Earned=Purchase Amount×Cashback Rate (decimal)

Worked Example

| Category | Spend | Rate | Calculation | Cashback |

|---|---|---|---|---|

| Groceries | $400 | 5% | 400 × 0.05 | $20.00 |

| Gas | $150 | 3% | 150 × 0.03 | $4.50 |

| Dining | $200 | 3% | 200 × 0.03 | $6.00 |

| Other | $250 | 1% | 250 × 0.01 | $2.50 |

| Total | $1,000 | — | — | $33.00 |

Effective Rate: 3.3% on $1,000 spend

To make it even easier for you to see exactly how much you’ll earn, we’ve included a fully functional cashback calculator right here. Simply enter any purchase amount and your card’s cashback rate to get an instant estimate of your rewards.

Cashback Calculator

Key Factors Influencing Cashback

- Eligible vs. Ineligible Transactions

Cash advances, balance transfers, gambling, and some utility or tax payments often earn no cashback. Always check your card’s terms. - Merchant Category Codes (MCCs)

Four-digit MCCs assigned by card networks determine category classification. For example, Walmart’s grocery department (MCC 5411) versus general merchandise (MCC 5399) can affect your rate. Learn more from Investopedia. - Spending Caps & Limits

Monthly, quarterly, or annual caps cap your bonus-rate earnings. A 5% grocery card might cap at $1,500 per quarter (max $75 cashback). - Redemption Minimums & Frequency

Some issuers require a $25 minimum before redemption; others allow any accrued amount. - Annual Fees vs. Break-Even

Calculate break-even spending:Break-Even Spend=Annual FeeEffective Cashback RateBreak-Even Spend=Effective Cashback RateAnnual FeeA $95 fee at 1.5% requires $6,333 in spend to break even. For fee comparisons, see our Annual Fee vs. Cashback Comparison.

Regional Insights: US, UK & Canada

For deeper regional analysis, see NerdWallet Canada’s best cashback cards and FCA guidelines in the UK.

Advanced Considerations & Pro Tips

- Promotional Launch Bonuses: Introductory 10% back on $1,500 spend can supercharge first-year returns—then revert to standard rates.

- Stacking Offers: Combine issuer portals (e.g., Chase Ultimate Rewards) with purchase-level promos for extra savings.

- No Foreign Transaction Fee Cards: Essential for travellers; otherwise 3% fees can nullify your earnings.

Common Mistakes & How to Avoid Them

- Carrying a Balance: Interest rates (18–29%) quickly outweigh cashback benefits—always pay in full.

- Chasing Rates: High rates don’t matter if caps or fees wipe out gains.

- Overspending: Only spend what you would normally; don’t buy extras just to earn rewards.

Overspending for Rewards

Never spend money unnecessarily just to earn cashback. The best rewards strategy involves earning cashback on spending you would do anyway.

Frequently Asked Questions

Is cashback real money?

Yes, cashback represents actual monetary value that can be used flexibly, unlike points or miles that have variable redemption values.

Are there tax implications for cashback?

In most cases, cashback is considered a rebate rather than income and isn’t taxable. However, large sign-up bonuses ($600+) may be reportable.

Can cashback rates change?

Yes, issuers can modify rates with appropriate notice. Promotional rates especially are subject to change or expiration.

How do I redeem cashback?

Most issuers offer multiple redemption options including statement credits, direct deposits, checks, and gift cards. Check your specific card’s redemption portal or contact customer service.

Do all purchases earn cashback?

No, certain transaction types like cash advances, balance transfers, and some utility payments typically don’t earn rewards.

Mastering how cashback credit cards calculate rewards empowers you to choose the best card and earn maximum value. By understanding calculation methods, caps, MCCs, and regional factors, you’ll transform everyday purchases into real savings.

Ready to optimize your rewards? Explore our in-depth guides on:

- How credit cards determine which categories earn higher rewards for cashback:

- What factors influence the calculation of cashback rewards across different cards:

- How limits or caps affect the total cashback earned:

- Why some cashback rates vary by purchase type or merchant category.

- Steps to accurately calculate cashback rewards for your specific card:

Make cashback work for you—spend wisely, track your categories, and watch your rewards add up!

Thank you for sharing really helpful