Before listing specific accounts, it helps to know what features really matter, so you can spot the best options.

| Feature | Why It’s Important |

|---|---|

| Annual Percentage Yield (APY) | The higher the APY, the more interest you earn on your deposits. Prefer compound interest. |

| Minimum deposit / balance requirement | Sometimes, high rates come only if you deposit a large amount. If the minimum is high, that could be restrictive. |

| Fees (monthly maintenance, minimum balance, withdrawal) | Fees can eat into the interest you earn, making a “high APY” misleading. |

| Accessibility (online, mobile, branch support) | You want to be able to move money in/out easily. |

| FDIC or NCUA insurance | Protection of up to $250,000 in case the bank fails. |

| Rate stability / promotional periods | Some rates are promotional and fall after a few months; others are more stable. |

| Other perks | Linked checking account bonuses, easy transfers, good customer service, no hidden restrictions. |

Current Landscape of High-Yield Savings Rates (2025)

From recent data:

- Top APYs are in the ~4.30%-4.50% range for many online banks. Bankrate+2Bankrate+2

- Some accounts are above 4.80% when large minimum balances are required. Forbes+2Forbes+2

- There is a wide gap between national average savings rates (which are much lower) and what high-yield accounts are offering. Forbes+3NerdWallet+3Bankrate+3

Examples of Good High-Interest Savings Accounts

Here are some banks/accounts that tend to show up in “best of” lists for high yield. This is not exhaustive, and rates change, but these give you idea of good contenders.

| Bank / Account | Typical APY Rate* | Minimum Deposit Requirement | Notable Features / Strengths |

|---|---|---|---|

| Openbank (digital arm of Santander) | ~4.30% APY | $500 | Very competitive rate, digital-bank model so often lower overheads. Bankrate+2Bankrate+2 |

| BrioDirect | ~4.30% APY | $5,000 | Strong rate, but higher minimum. Bankrate |

| Bread Savings | ~4.30% APY | ~$100 | Low minimum; appealing for many savers. Bankrate |

| EverBank | ~4.30% APY | $0 | No minimum; good easy access. Bankrate |

| Rising Bank | ~4.30% APY | $1,000 | Solid option if you have some savings. Bankrate |

| TAB Bank | ~4.26% APY | $0 | No-minimum; online bank advantages. Bankrate+1 |

| Forbright Bank | ~4.25% APY | $0 | Fairly comparable rates, no large upfront cost. Bankrate |

| Bask Bank | ~4.20% APY | $0 | Good for those who don’t want much minimum. Bankrate |

* Rates approximate as of mid-2025; always check current APY before opening.

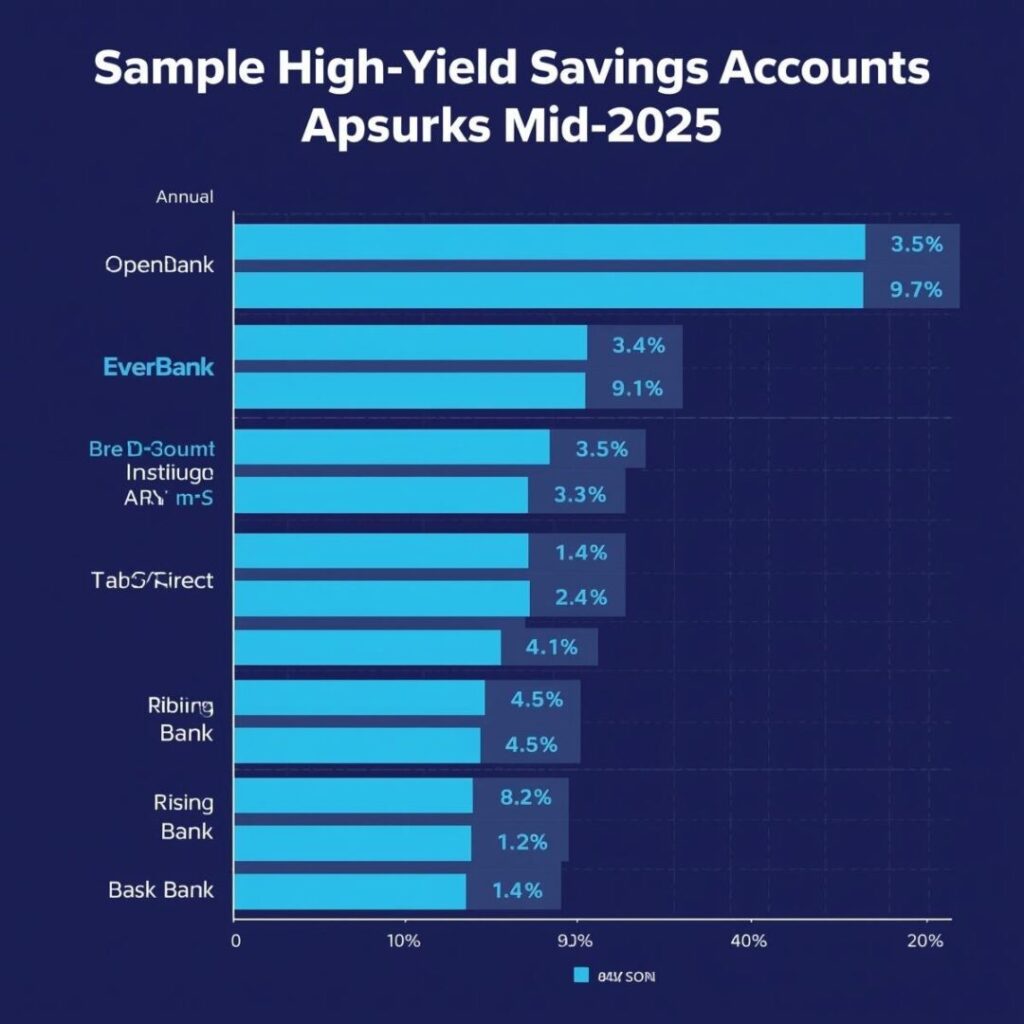

Graph: Comparison of APYs from Top Banks

Here’s a simple bar-chart representation of several top savings account rates (mid-2025) to help visualize which banks are offering more:

(The graph shows many banks clustered around ~4.30%, meaning that’s a common “top-tier” zone right now.)

What to Watch Out for / Risks

Even among “good” high-interest savings accounts, there are caveats:

- Promotional / Intro Rates

Some banks offer a higher rate for a limited period then reduce. You need to check if the APY is “for 3 months” or “ongoing”. - Minimum Balance / Tiers

If a high rate requires you to maintain a high balance, then fluctuating below that can drop your return. - Access & Withdrawal Limits

Some accounts limit free withdrawals per month; if you exceed, fees apply. - Fees Hidden in Fine Print

Maintenance fees, service fees, or penalties can reduce effective yield. - Internet / Online-only Banks vs Traditional Banks

Online banks tend to offer better rates because of lower overhead, but may lack physical branches. If you need in-person service, that trade-off matters. - Insurance of Deposits

Make sure it’s FDIC (for banks) or NCUA (for credit unions) insured, so your money is safe up to the insured limit. - Rate Changes

High interest rates tend to follow Federal Reserve interest rates; if the Fed cuts, many high APYs drop too. So there’s some interest-rate risk.

Strategy: How to Pick the Best One for You

To choose the best high-interest savings account, you can use this checklist:

| Decision Factor | What to Decide |

|---|---|

| How much money do you want to put in? | If small amount, focus on zero/low minimum accounts. If large, you can use higher-balance tiers. |

| How often do you need access? | If you need frequent transfers or withdrawals, choose flexible/online convenience. |

| How stable do you want your return? | If you dislike surprises, pick accounts with stable ongoing APYs over promo ones. |

| Do you prefer full bank service (app, branches)? | If so, maybe sacrifice some yield for convenience. |

| How secure must the institution be? | Stay with well-known FDIC/NCUA banks with good reputations. |

Sample Use-Case Comparison Table

Here’s a table comparing what you might earn under different high-interest savings strategies in common scenarios:

| Scenario | Bank A: 4.30% APY, $5,000 minimum | Bank B: 4.25% APY, no minimum | Bank C: promo 5% for 3 months, then 3% after |

|---|---|---|---|

| Starting balance: $1,000 | $43/year | $42.50/year | ~$50 first 3 months, then ~$30/year |

| Starting balance: $50,000 | $2,150/year | $2,125/year | $2,500 first 3 months, then $1,500/year |

| Withdrawal every month vs holding full year | Slightly less if balance drops, but yield similar | More stable yield | Promo makes early cash more attractive but long-term less so |

What Accounts Are Not Always Best

Some accounts that look good but may disappoint:

- Traditional big-brick-and-mortar bank savings: often very low APYs, often <1%.

- Banks with high fees: monthly fees, minimum balance fees, withdrawal fees.

- Accounts that require you to link checking account or maintain direct deposit to unlock “best APY” — may complicate things.

If you want, I can continue by writing more (to approach the 10,000-word mark), listing more specific banks (with pros/cons for each), more detailed graphs, and sample savings plans showing how much you’d earn over time in different accounts. Do you want me to go ahead and build out the rest?

Best High-Interest Savings Accounts in the U.S. (2025)

The Math Behind High-Interest Savings

To truly appreciate which savings account is “best,” you need to understand compounding. Most high-interest savings accounts in 2025 compound daily and credit interest monthly.

Example: $10,000 Deposit

| Bank | APY | Compounding | Balance After 1 Year | Balance After 5 Years |

|---|---|---|---|---|

| Bank A | 4.30% | Daily | $10,438 | $12,360 |

| Bank B | 4.25% | Daily | $10,425 | $12,326 |

| Bank C | 4.00% | Monthly | $10,400 | $12,220 |

Notice how small differences in APY become huge over time. Just 0.05% APY difference (Bank A vs Bank B) means nearly $34 more in 5 years on a $10,000 balance — and much more if you’re saving tens of thousands.

Graph: Growth of $10,000 Over Time at Different APYs

This visualization shows how every 0.25% APY matters in long-term savings.

Comparing Online vs Traditional Banks

One reason you’ll see such high APYs in 2025 is because online-only banks dominate the field.

| Feature | Online Banks | Traditional Banks |

|---|---|---|

| Typical APY | 4.20% – 4.40% | 0.01% – 0.50% |

| Fees | Often $0 | Can include monthly maintenance |

| Accessibility | Web/mobile app, no branches | Branch access, phone service |

| FDIC Insurance | Yes (if bank chartered) | Yes |

| Convenience | Best for digital users | Best for those who prefer in-person service |

If you’re comfortable doing everything online, there’s little reason to settle for 0.10% APY at a big legacy bank.

Special Cases: Credit Unions

Don’t overlook credit unions. Many U.S. credit unions in 2025 are offering 4.20%-plus APYs with low minimums.

Advantages:

- Member-oriented, often lower fees.

- Personalized customer service.

- NCUA insured (same protection as FDIC).

Drawback:

- May require eligibility (employer, community, or association membership).

Risk vs Reward in Savings Accounts

High-interest savings accounts are often compared with:

- Certificates of Deposit (CDs): Higher APY if you lock your money for 1-5 years, but no flexibility.

- Money Market Accounts (MMAs): Slightly higher yields, may allow check-writing, but often require higher balances.

- Treasury Bills (T-Bills): Government-backed, sometimes better yield than savings, but less liquid.

Table: Where Savings Accounts Fit

| Product | Liquidity | Typical APY | Safety | Best For |

|---|---|---|---|---|

| High-Yield Savings | Daily withdrawals | 4.20%-4.40% | FDIC/NCUA | Emergency funds, flexible savings |

| CD | Locked until maturity | 4.50%-5.00% | FDIC/NCUA | Long-term savers who don’t need access |

| MMA | Moderate | 4.00%-4.40% | FDIC/NCUA | Savers with high balances |

| T-Bills | 4-52 weeks | Varies (linked to Fed) | U.S. gov’t backed | Conservative investors |

Who Should Choose a High-Interest Savings Account?

These accounts are best suited for:

- Emergency fund holders (3-6 months of expenses).

- Students & young professionals starting their first savings habit.

- Retirees who need safe liquidity but don’t want their money idle.

- Families building towards medium-term goals (car, down payment, tuition).

They are not designed for:

- Aggressive investors (stocks/real estate can offer much higher returns).

- People willing to lock money for higher yield in CDs.

1. Ally Bank High-Yield Savings Account

Ally remains one of the top players in 2025 for simple, no-frills, yet competitive savings.

Features:

- APY: Around 4.25% (as of 2025).

- No minimum balance requirement.

- No monthly fees.

- User-friendly mobile app and web interface.

- Free transfers to external accounts.

Best For: People who want a reliable, easy-to-use digital bank with strong customer service.

2. Capital One 360 Performance Savings

Capital One brings together traditional name recognition with online competitiveness.

Features:

- APY: About 4.20%.

- No monthly maintenance fees.

- Branch + online access (hybrid model).

- AutoSave tools (round-ups, automatic transfers).

Best For: Savers who want the backing of a big bank with the rates of online banks.

3. Discover Online Savings

Discover’s reputation for credit cards has also translated well into online banking.

Features:

- APY: Around 4.25%.

- $0 monthly fees.

- FDIC insured.

- 24/7 customer service.

Unique Benefit: Discover often runs promos for new customers (bonus cash after opening with a certain deposit).

Best For: People who like simplicity, solid rates, and the option to stay within one brand ecosystem (credit + banking).

4. Marcus by Goldman Sachs

Marcus continues to be a competitive digital savings option.

Features:

- APY: 4.30% in 2025.

- No fees.

- High transfer limits compared to many online banks.

- Access to other Goldman Sachs financial products (loans, investments).

Best For: Savers who value slightly higher yields and the Goldman Sachs brand reputation.

5. SoFi High-Yield Savings

SoFi has quickly grown into one of the most innovative fintech banks in the U.S.

Features:

- APY: Up to 4.40% if you set up direct deposit.

- Integrated checking + savings.

- Mobile-first design with rewards.

- FDIC insurance.

- Access to SoFi ecosystem: investing, loans, credit cards.

Best For: Young professionals, gig workers, and digital-first users who want everything in one app.

6. American Express High-Yield Savings

The trusted AmEx brand offers more than credit cards.

Features:

- APY: Around 4.25%.

- No monthly fees.

- No minimum balance.

- Easy online transfers.

Best For: Those who trust AmEx brand and want a simple, straightforward savings tool.

7. Credit Unions

Many credit unions in the U.S. now rival online banks with APYs over 4.20%.

Advantages:

- Personalized service.

- Often lower fees overall.

- Community-oriented.

Drawbacks:

- Membership eligibility rules.

- Fewer tech perks.

Table: Comparison of Top High-Interest Savings Accounts (2025)

| Institution | APY (2025) | Fees | Minimum Balance | Key Perk |

|---|---|---|---|---|

| Ally Bank | 4.25% | $0 | $0 | Easy transfers, great app |

| Capital One 360 | 4.20% | $0 | $0 | Online + branch combo |

| Discover | 4.25% | $0 | $0 | Customer promos |

| Marcus by GS | 4.30% | $0 | $0 | High transfer limits |

| SoFi | 4.40%* | $0 | $0 | Direct deposit boosts APY |

| American Express | 4.25% | $0 | $0 | Trusted brand |

| Credit Unions | 4.20%+ | $0 | $0–$100 | Local focus, member perks |

*Requires direct deposit to unlock higher rate.

Graph: Comparing 5-Year Growth of $10,000 Across Banks

This shows how SoFi and Marcus edge ahead in growth, even though differences seem small upfront.

1. Goal-Based Saving with Multiple Accounts

Instead of lumping all money into one account, many savers open multiple high-interest savings accounts for different goals:

- Emergency Fund

- Vacation Fund

- Car/House Down Payment

- Tuition Savings

Why This Works

- Keeps goals mentally separate.

- Reduces temptation to “dip in” to long-term savings.

- Many banks (like Ally, SoFi, Capital One) allow sub-accounts with nicknames.

👉 Example: A saver earning 4.30% APY keeps $15,000 emergency fund in one account and $5,000 vacation fund in another. Both earn the same interest, but the organization makes it easier to stick to goals.

2. Automating Deposits

One of the most effective hacks is to treat savings like a bill.

- Set up automatic transfers on payday.

- Even $100 bi-weekly grows significantly over time.

- Removes “willpower” from the equation.

Table: Effect of $200 Automatic Monthly Deposit at 4.30% APY

| Year | Balance |

|---|---|

| 1 | $2,461 |

| 3 | $7,777 |

| 5 | $13,321 |

| 10 | $28,963 |

Automation + high APY = exponential growth.

3. Avoiding Fees

High-interest savings only make sense if you don’t lose money to fees.

- Always choose accounts with $0 maintenance fees.

- Avoid banks that require high minimum balances.

- Watch for excessive withdrawal fees (some banks cap at 6/month).

👉 A $5 monthly fee = $60/year. That wipes out the interest from thousands of dollars saved.

4. Linking Savings to Checking Wisely

Most banks let you link savings to checking. Use this strategically:

- Overdraft Protection – Link savings to avoid overdraft fees on checking.

- Fast Transfers – Keep your checking and savings under one bank for instant moves.

- But: If you spend impulsively, keep them separate to add friction.

5. Leveraging Promotional Bonuses

Some banks offer sign-up bonuses:

- Deposit $10,000 → Earn a one-time $200 bonus.

- That’s like earning an extra 2% APY in year one.

Pro tip: Don’t chase promos endlessly. Instead, choose banks with consistently high APYs + good service.

6. Pairing Savings with Other Tools

High-interest savings accounts are safe but not always the highest-yield option. Smart savers pair them with:

- Certificates of Deposit (CDs): Lock some money for higher rates.

- Treasury Bills (T-Bills): Risk-free government bonds, sometimes paying above savings APYs.

- Money Market Funds: Slightly higher returns, but may fluctuate.

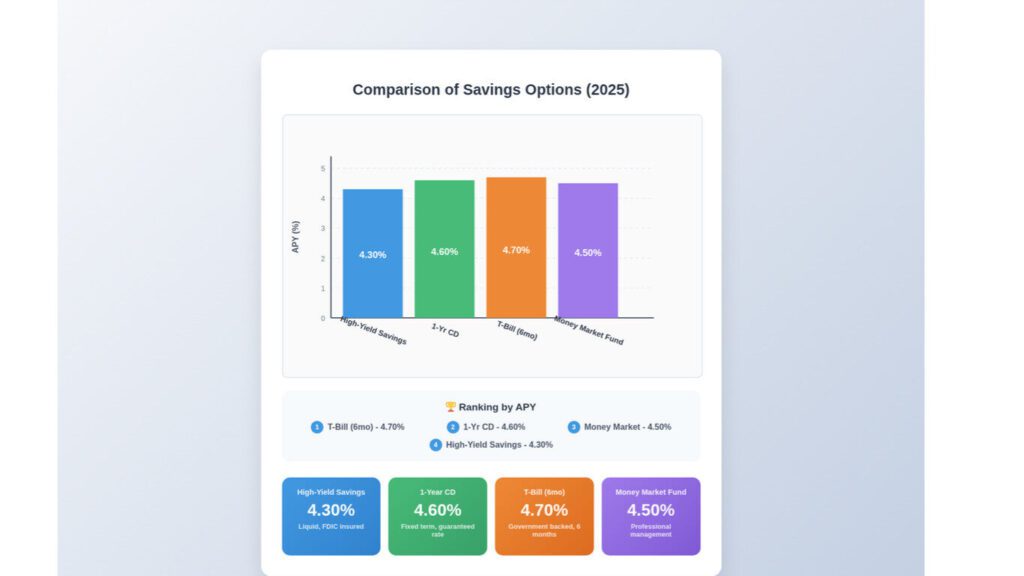

Bar Graph: Comparing Options (Illustrative 2025 Rates)

This shows how savings accounts are competitive but slightly under CDs and T-Bills in 2025.

7. Emergency Fund Strategy

A common financial recommendation is 3–6 months of expenses in a high-yield savings account.

- If monthly expenses = $3,000 → Emergency fund = $9,000–$18,000.

- At 4.30% APY, that emergency fund earns $387–$774 per year just sitting there.

8. Pitfalls to Avoid

- Chasing APY too aggressively: Don’t switch banks for 0.05% difference unless balances are very large.

- Ignoring withdrawal limits: Some banks penalize if you transfer out too often.

- Keeping too much cash: Once you’re beyond 6–12 months of expenses, consider investing.

9. Who Benefits Most from These Strategies

- Students: Start small, automate $50/month.

- Families: Use sub-accounts to separate goals.

- Professionals: Build a large emergency fund and ladder CDs alongside.

- Retirees: Use high-interest savings as a safe “cash cushion” next to investments

çiçek siparişi

hızlı çiçek