- Introduction: Credit Cards at a Crossroads

- A Brief Look Back: How Credit Cards Evolved

- The Digital Transformation of Payments

- Contactless, mobile wallets, biometrics

- AI and Machine Learning in Credit Cards

- Fraud detection, personalized offers

- Credit Cards vs. Alternative Payments

- BNPL, digital wallets, crypto

- Rewards and Loyalty Programs of the Future

- Gamification, dynamic rewards

- The Role of Regulation

- Consumer protection, fees, transparency

- Security and Identity Protection

- Biometrics, tokenization, blockchain

- Globalization of Credit Cards

- Wider acceptance, cross-border innovations

- Sustainability in Credit Cards

- Green cards, eco-rewards

- Financial Inclusion and Credit Building

- Students, immigrants, underserved communities

- Predictions for 2030 and Beyond

- Graphs & Tables

- Usage trends, digital adoption, BNPL vs. credit growth, etc.

- Conclusion: Where We’re Headed

Introduction – Credit Cards at a Crossroads

Credit cards are no longer just pieces of plastic. In 2025, they stand at the intersection of technology, finance, and lifestyle. For decades, they’ve been the go-to tool for spending and borrowing, but now they’re being challenged by digital wallets, cryptocurrencies, and buy-now-pay-later models.

Yet instead of becoming obsolete, credit cards are evolving into something smarter, faster, and more personalized. The question is not whether they will survive, but what form they will take in the future.

Graph 1: Credit Card Usage Trends in the U.S. (2015–2025)

A Brief Look Back – How Credit Cards Evolved

To understand their future, we need to revisit the journey.

- 1950s → The Diners Club card, the birth of “charge cards.”

- 1970s–80s → Visa and MasterCard expand globally, credit lines become mainstream.

- 1990s–2000s → Online shopping drives card adoption.

- 2010s → Chip cards, rewards wars, and digital banking emerge.

- 2020s → Contactless, mobile wallets, and AI-driven personalization.

This history shows that credit cards are adaptive tools — every decade, they’ve changed to meet new consumer and technological demands.

The Digital Transformation of Payments

Credit cards are no longer tied to a piece of plastic. Instead, the future is digital-first:

- Contactless Payments → Already mainstream, will become the default.

- Mobile Wallets → Apple Pay, Google Wallet, Samsung Pay integrating seamlessly.

- Biometric Authentication → Fingerprints, face scans replacing PINs.

- Virtual Cards → One-time-use card numbers for online safety.

Graph 2: Contactless Credit Card Adoption (2020–2025)

AI and Machine Learning in Credit Cards

Artificial Intelligence (AI) and Machine Learning (ML) are no longer futuristic buzzwords. They are already powering the modern credit card industry. From detecting fraud in real time to tailoring offers for individual cardholders, AI is transforming credit cards into smart financial tools.

In the coming years, AI won’t just improve convenience — it will define the competitive edge among issuers. The card companies that harness AI effectively will capture more loyalty, reduce losses, and deliver better customer experiences.

1. AI in Fraud Detection

One of the earliest and most impactful uses of AI in credit cards has been fraud detection.

- Pattern Recognition: AI systems learn your spending behavior and flag unusual activity.

- Real-Time Alerts: If your card is suddenly used in another country or for a strange purchase, AI instantly pauses it.

- Adaptive Learning: Instead of fixed rules, AI improves with every transaction, making detection smarter over time.

This means fraud cases are detected within seconds, minimizing both customer stress and financial loss.

2. AI for Personalized Offers and Rewards

Credit card companies are moving beyond one-size-fits-all promotions. With AI:

- Your card can suggest rewards tailored to your habits (e.g., if you spend heavily on groceries, you’ll get bonus cashback at supermarkets).

- AI predicts future needs — for example, offering travel rewards when you start booking flights.

- Rewards programs will feel like custom loyalty programs, unique to each cardholder.

Table: Traditional vs. AI-Powered Credit Card Experience

| Feature | Traditional Credit Card | AI-Powered Credit Card |

|---|---|---|

| Fraud Detection | Based on static rules | Real-time, adaptive, behavior-driven |

| Offers & Rewards | Same for all cardholders | Personalized to spending habits |

| Customer Service | Call centers, scripted support | AI chatbots + predictive solutions |

| Credit Limit Decisions | Based on income & credit score | Based on real-time spending & risk data |

| Risk Management | Broad categories | Micro-level analysis, predictive models |

3. AI-Driven Credit Decisions

Traditionally, lenders judged applications based mostly on credit scores. AI is now expanding the picture:

- Real-Time Data Analysis → AI can factor in rent payments, utilities, or subscription histories.

- Dynamic Credit Limits → Instead of fixed limits, AI can raise or lower your credit line based on spending patterns.

- Better Inclusion → Students, immigrants, and gig workers with thin credit files get fairer evaluations.

This makes credit cards more accessible and flexible to a wider audience.

4. Customer Support and Virtual Assistants

Imagine never waiting on hold again. AI chatbots are transforming customer service:

- Instantly answer questions like “What’s my balance?”

- Help dispute transactions in seconds.

- Proactively warn you about unusual charges or upcoming bills.

In the near future, AI assistants could manage your credit card like a financial advisor, guiding you toward smarter spending and repayment strategies.

Graph: AI Use Cases in Credit Cards (2025 Projection)

5. The Risks of AI in Credit Cards

While AI offers efficiency, it brings challenges too:

- Privacy Concerns → AI requires massive amounts of data, raising questions about personal information security.

- Bias in Algorithms → If AI is trained on biased data, it could unfairly reject or limit applicants.

- Over-Reliance on Automation → Mistakes in automated systems could lock people out of accounts.

Issuers must strike a balance between innovation and ethical responsibility.

6. The Future: Hyper-Personalized, AI-Driven Cards

Imagine this scenario in 2030:

- Your credit card automatically increases cashback at your favorite café because it notices you go there daily.

- Before you make a big purchase, the card’s AI assistant warns: “If you wait two weeks, you’ll get a discount.”

- Fraud detection becomes invisible — no calls, no alerts, just seamless blocking of bad actors.

This is where AI is taking credit cards: invisible, predictive, and deeply personalized financial companions.

Credit Cards vs. Alternative Payments (BNPL, Wallets, Crypto)

For decades, credit cards dominated the way Americans spent and borrowed. They were symbols of convenience, rewards, and financial flexibility. But in recent years, new challengers have entered the arena — Buy Now Pay Later (BNPL), digital wallets, and cryptocurrencies.

The future of credit cards depends on how they adapt to these alternatives. Will they lose ground, or will they evolve to stay central in the financial lives of consumers?

1. Buy Now, Pay Later (BNPL)

BNPL services like Afterpay, Klarna, and Affirm have exploded in popularity, especially among younger consumers.

- How it Works: Shoppers split purchases into equal installments, often interest-free if paid on time.

- Why Consumers Love It: Simpler than applying for a card, transparent terms, and no revolving debt.

- Risks: Late fees, overspending, and the possibility of unregulated lending practices.

BNPL has forced credit card companies to rethink how they structure installment plans. Many issuers now offer “Plan It” or “Pay Over Time” features, mimicking BNPL flexibility.

2. Digital Wallets

Digital wallets (Apple Pay, Google Wallet, Samsung Pay) are not competitors in the traditional sense. In fact, most wallets are powered by credit cards.

- They make cards invisible, integrating them into phones and wearables.

- Wallets offer faster checkout, biometric security, and seamless integration with apps.

- For consumers, the shift is less about abandoning cards and more about how cards are accessed.

Wallet adoption has surged because convenience now rivals rewards as a key driver of payment choice.

3. Cryptocurrencies and Stablecoins

Cryptocurrencies present a different challenge. They were created to bypass traditional banks and card networks altogether.

- Pros: Fast cross-border payments, lower fees, and decentralized ownership.

- Cons: Volatility, lack of consumer protection, and regulatory uncertainty.

- Stablecoins (crypto tied to the dollar) are gaining more traction than Bitcoin for daily transactions.

Card networks are adapting — Visa and Mastercard have partnered with crypto platforms to issue crypto-backed debit and credit cards, bridging the gap between traditional finance and blockchain.

Table: Comparing Credit Cards vs. Alternatives

| Feature | Credit Cards | BNPL | Digital Wallets | Cryptocurrency |

|---|---|---|---|---|

| Convenience | Widely accepted, global use | Easy for online shopping | Instant phone/tap payments | Growing acceptance, still limited |

| Rewards | Cashback, miles, points | Minimal or none | Linked to cards (inherits rewards) | Few reward structures |

| Debt Structure | Revolving credit, interest charges | Fixed installments | N/A (depends on linked method) | No debt; spend only what you own |

| Security | Strong, regulated, fraud protection | Varies, often weaker regulation | Tokenization & biometric security | Mixed; depends on wallet/exchange |

| Consumer Protections | Strong dispute rights | Limited | Tied to card protections | Very limited |

4. Why Credit Cards Still Matter

Despite the rise of alternatives, credit cards retain powerful advantages:

- Global Acceptance: No rival matches their reach.

- Rewards & Perks: Still the richest loyalty programs in finance.

- Consumer Protection: Chargebacks, fraud liability, extended warranties.

- Flexibility: Cards combine payment, short-term loans, and benefits in one product.

Alternatives may eat into specific segments (small online purchases, niche crypto use, etc.), but credit cards remain the backbone of consumer payments.

5. The Hybrid Future

Rather than losing relevance, credit cards are evolving to integrate with new systems:

- BNPL features built directly into credit card apps.

- Digital wallets making cards more secure and frictionless.

- Crypto-linked credit cards bridging old and new finance.

The future isn’t “cards vs. alternatives.” It’s cards plus alternatives, with issuers embedding flexibility, innovation, and consumer choice into every swipe or tap.

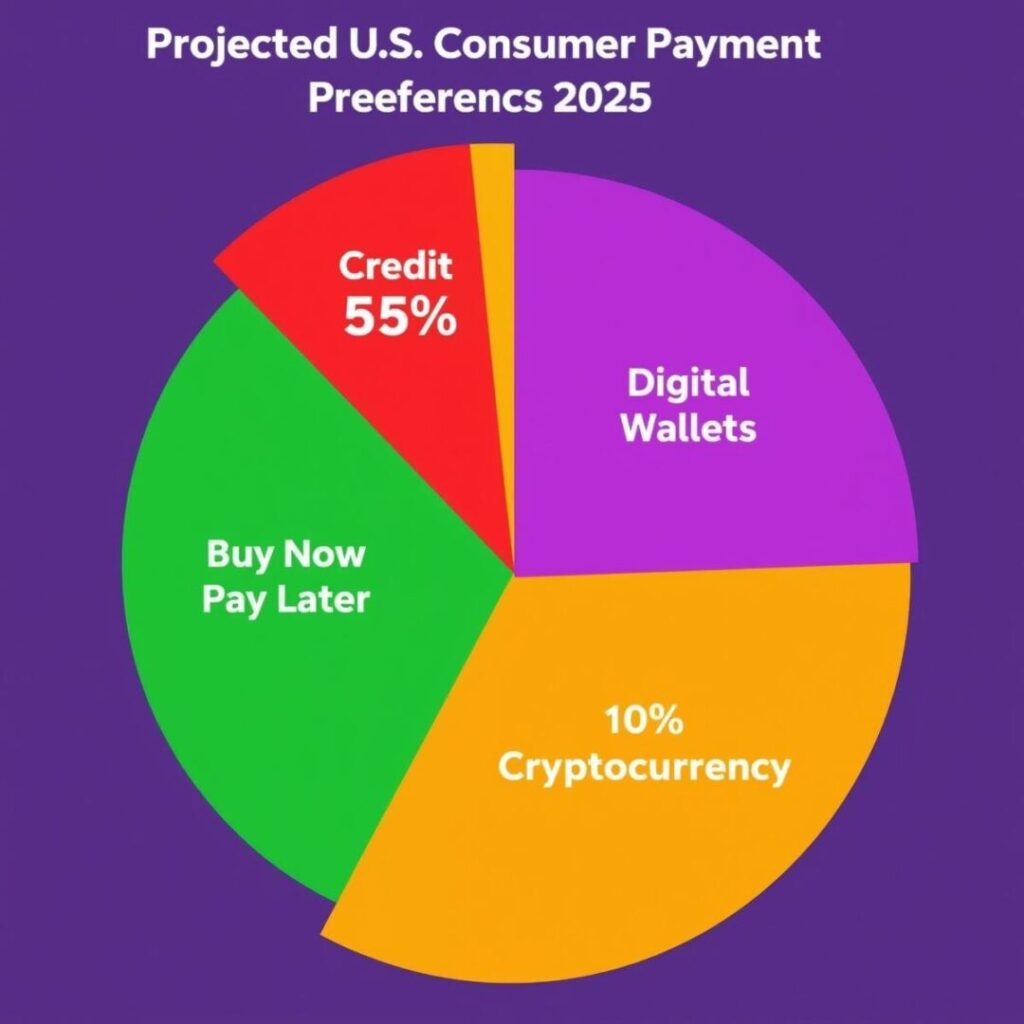

Graph: U.S. Payment Preferences (2025 Projection)

6. Consumer Choice and Psychology

At the end of the day, payment isn’t just financial, it’s emotional. Consumers want:

- Control (BNPL gives predictable payments).

- Ease (wallets give one-tap checkout).

- Trust & Safety (cards give strong protections).

- Innovation (crypto offers a taste of the future).

Credit cards that blend these desires will remain dominant — even as new players grow.

Part 6: Sustainability and Green Credit Cards

The financial world is no longer only about money. Consumers today want their purchases to reflect their values. That shift has given rise to sustainable and green credit cards — products designed to reward eco-friendly behavior, support environmental causes, and reduce the carbon footprint of everyday spending.

The future of credit cards will be shaped not only by technology but also by conscience. Let’s dive into how sustainability is transforming plastic into a tool for planetary good.

1. The Rise of Eco-Conscious Spending

- Generational Demand: Millennials and Gen Z are leading the push for green financial products. Surveys show they’re more willing to switch to providers that align with their values.

- Corporate Responsibility: Banks and card issuers face pressure to demonstrate environmental, social, and governance (ESG) commitments.

- Consumer Behavior: Shoppers are more likely to choose cards that support tree-planting, renewable energy, or charities.

This cultural shift means credit cards are no longer neutral. They’re signals of identity and responsibility.

2. What Makes a Credit Card “Green”?

Sustainable cards go beyond branding. They typically include:

- Eco-Friendly Materials: Many issuers now produce cards from recycled PVC or even biodegradable materials.

- Carbon Offset Programs: Some cards calculate the footprint of purchases and fund offsetting projects like reforestation.

- Donation Features: A percentage of every transaction supports climate or social initiatives.

- Green Rewards: Extra cashback or points for eco-friendly purchases — like public transport, EV charging, or organic groceries.

Table: Features of Traditional vs. Green Credit Cards

| Feature | Traditional Credit Card | Green Credit Card |

|---|---|---|

| Material | Standard plastic | Recycled, biodegradable, or digital-only |

| Rewards | Travel, cashback, generic spending categories | Eco-related spending, sustainable lifestyle incentives |

| Impact Programs | Limited | Donations, carbon offsets, charity contributions |

| Consumer Identity | Status, rewards | Values, responsibility, sustainability |

3. Examples of Sustainable Initiatives

- Tree-Planting Rewards: Some cards plant a tree for every $1,000 spent.

- Eco-Travel Perks: Partnering with airlines offering carbon-neutral flights.

- Circular Economy Support: Rewards for buying secondhand, renting, or recycling.

- Digital-Only Cards: Reducing plastic by offering app-only virtual cards.

These initiatives are not just symbolic — they also differentiate issuers in a crowded market.

4. Why Sustainability Matters to Issuers

From a business perspective, sustainable credit cards are not only about saving the planet — they’re about winning customer loyalty.

- Attract Younger Users: Gen Z, entering the workforce, is a prime target for lifelong banking relationships.

- Brand Reputation: A green card enhances trust and social capital.

- Regulatory Trends: Governments are pushing financial institutions toward ESG compliance.

Issuers see sustainability as both a moral imperative and a competitive advantage.

5. Challenges for Green Credit Cards

Despite the momentum, several challenges remain:

- Greenwashing Risks: Not all eco-claims are transparent. Consumers demand proof of impact.

- Higher Costs: Funding offsets or donations can reduce issuer profit margins.

- Limited Awareness: Many consumers don’t even know green cards exist.

For green cards to succeed, issuers must deliver authentic, measurable impact, not just marketing slogans.

6. The Future: Sustainability at the Core

Looking ahead, sustainability will become mainstream, not a niche. Future credit cards may:

- Automatically track the carbon footprint of each purchase.

- Give dynamic rewards (e.g., higher cashback for low-impact purchases).

- Offer personalized eco-goals, like “spend more on public transit this month.”

- Partner with ESG investment funds for reward redemptions.

The credit card of 2030 may not just tell you your balance. It may show your environmental balance too.

Graph: Growth of Green Credit Card Adoption (Projection 2020–2030)

7. Why This Trend is Unstoppable

Ultimately, green credit cards are part of a bigger movement — a world where finance serves not just profit, but purpose.

Consumers increasingly ask: “What impact does my money make?”

Credit cards, used billions of times every day, are a perfect answer to that question.

By blending sustainability with convenience and rewards, credit cards will remain relevant, powerful, and aligned with future values.

The Role of AI and Personalization in Credit Cards

If technology has been the backbone of credit card innovation, AI is the brain that powers the future. In 2025 and beyond, artificial intelligence is no longer just an add-on. It is becoming the core engine behind fraud prevention, customer service, rewards, and personalized financial insights.

The days when a credit card was just a piece of plastic are gone. The next generation of cards will act like financial assistants, helping people spend smarter, save more, and stay protected.

1. AI in Fraud Detection and Security

One of the strongest use cases of AI in credit cards is fraud prevention.

- Real-Time Monitoring: AI systems analyze thousands of data points instantly — from purchase location to device ID — to detect unusual behavior.

- Pattern Recognition: Unlike old rules-based systems, AI learns from evolving fraud patterns. If your card is used in two different states within minutes, AI spots it instantly.

- Reduced False Declines: Traditional fraud systems often reject legitimate transactions. AI reduces these “false positives,” protecting both the consumer and the merchant.

By 2030, experts predict that nearly all credit card fraud detection will be AI-driven.

2. AI in Customer Service

Chatbots and virtual assistants are no longer robotic scripts. With generative AI, banks now offer human-like conversations for credit card support.

- 24/7 Support: No waiting for office hours.

- Personalized Help: AI can pull up transaction history, rewards status, and payment options instantly.

- Proactive Alerts: Instead of waiting for you to ask, AI might say: “Your payment is due tomorrow. Would you like to schedule it now?”

This shift improves customer experience while cutting costs for issuers.

3. Personalized Rewards and Offers

In the past, rewards programs were one-size-fits-all: 1% cashback, or miles for travel. AI has changed that.

- Spending Insights: AI analyzes your habits — groceries, streaming, dining — and tailors rewards accordingly.

- Dynamic Offers: Retailers can push real-time deals, such as extra cashback at your favorite coffee shop this morning.

- Predictive Rewards: AI can forecast what categories will matter most to you and adjust benefits automatically.

Credit cards of the future will feel custom-built for every user, creating loyalty through relevance.

Table: Traditional vs. AI-Powered Credit Cards

| Feature | Traditional Credit Card | AI-Powered Credit Card |

|---|---|---|

| Fraud Detection | Rules-based, slower, more errors | Real-time, predictive, fewer false positives |

| Customer Support | Call centers, limited hours | 24/7 AI assistants, instant personalized responses |

| Rewards | Static categories, same for all users | Dynamic, personalized offers based on spending |

| Insights | Monthly statements only | Real-time financial coaching and recommendations |

| User Experience | Generic | Hyper-personalized and adaptive |

4. AI for Financial Health Coaching

AI isn’t just about spending — it’s also about teaching better money habits.

- Smart Nudges: If you’re overspending, AI may remind you to cut back.

- Budget Integration: AI credit cards may sync with household budgets automatically.

- Predictive Warnings: “Based on your past payments, you may carry a balance this month. Consider paying extra to avoid interest.”

In short, your credit card may become your financial fitness trainer.

5. Predictive Credit Scoring

Lenders traditionally relied on credit scores (FICO, VantageScore) based on past behavior. AI can do better:

- Alternative Data: Rent, subscriptions, utility payments.

- Real-Time Risk Analysis: AI evaluates your ability to pay dynamically, not just historically.

- Fairer Lending: AI may open credit access to people with thin credit files but responsible financial habits.

This could reshape access to credit for millions of Americans.

Graph: Adoption of AI in Credit Card Services (2020–2030 Projection)

6. The Human Element

Ironically, the more AI takes over, the more important human trust becomes. Consumers want:

- Transparency: Knowing how AI decisions (like fraud flags or loan approvals) are made.

- Control: Ability to override AI when necessary.

- Fairness: AI must avoid bias in credit scoring.

Issuers who combine AI with ethical, consumer-first practices will win loyalty.

7. The Future: Credit Cards as Smart Companions

By 2030, your credit card may:

- Alert you when you’re close to overspending.

- Offer you the best deal before you buy.

- Help you offset your carbon footprint.

- Negotiate better rates with merchants automatically.

Credit cards will no longer just process transactions — they will guide decisions

kora yedek parça

kore yedek parça